How Battery Chemistry Assumptions Distort Nickel And Cobalt Demand Forecasts

By Paul Homewood

John Petersen, long term industry veteran and expert on energy storage, is making a presentation to the World Bank this week about grid scale storage.

It will be based around his recent article below:

Summary

Over the last two decades, lithium-ion battery manufacturers have aggressively pursued advanced cathode formulations that partially replace expensive cobalt with cheaper nickel.

In general, increasing the nickel content in a cathode formulation will improve energy density but reduce stability, which means there’s a trade off between cost and safety.

While some battery manufacturers are touting improved stability in nickel-rich cathode formulations, many professionals are skeptical that the technical problems can be overcome.

Since chemistry assumptions have an enormous impact on nickel and cobalt demand forecasts, investors must understand and carefully evaluate all embedded assumptions.

Overview of lithium-ion cathode chemistries

The original lithium-ion batteries introduced by Sony (NYSE:SNE) in 1991 used a lithium-cobalt-oxide, or LCO, cathode powder that was roughly 60% cobalt by weight. While LCO has remained the preferred chemistry for personal electronics for almost 30 years, it was never viewed as an enabling chemistry for electric vehicles because cobalt is scarce and expensive and LCO cells have a less than spectacular safety record.

In 1996, lithium-iron-phosphate, or LFP, and lithium-manganese-oxide, or LMO, chemistries were introduced. While these new chemistries had lower energy density than LCO, they were far safer and they were made from abundant precursor materials. They were widely heralded as enabling chemistries for electric vehicles and most early EVs used LFP or LMO batteries.

In 1999, two nickel-rich cathode chemistries were introduced:

- The nickel-cobalt-manganese, or NCM/NMC, chemistry used equal proportions of nickel, cobalt and manganese to reduce the cobalt content from ~60% to ~20%.

- The nickel-cobalt-aluminum, or NCA, chemistry used mostly nickel with small amounts of cobalt and aluminum to reduce the cobalt content from ~60% to ~9%.

Since 1999 battery developers have continued their efforts to reduce cobalt content, however the pace of progress has been glacial. After almost 20 years of concerted R&D, manufacturers are currently producing:

- NCM-111, where cobalt is 20.3% of cathode powder weight;

- NCM-523, where cobalt is 12.2% of cathode powder weight;

- NCM-622, where cobalt is 12.2% of cathode powder weight;

- NCA-80,15,5, where cobalt is 9.2% of cathode powder weight; and

- NCA-84,12,4, where cobalt is 7.9% of cathode powder weight.

Three Asian battery developers, SK Innovation (OTC:SKOVF), LG Chem (OTCPK:LGCLF) and Samsung SDI (OTC:SSDIY), have announced plans to introduce NCM-811 chemistries sometime this year where cobalt will be 6.1% of cathode powder weight. Automakers that would like to use NCM-811 batteries are legion and include General Motors (GM), BMW (OTCPK:BMWYY), Volkswagen (OTCPK:VLKAF) and almost everybody except Tesla (TSLA), which prefers Panasonic (OTCPK:PCRFF) cells with NCA chemistry.

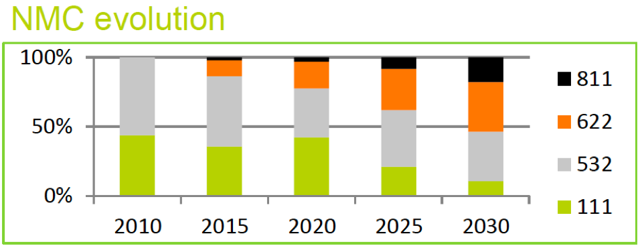

This graph from Avicenne Energy, a respected European battery consulting firm, shows how they expect the market share of various NCM formulations to evolve between now and 2030.

Technical challenges of nickel-rich cathode chemistries

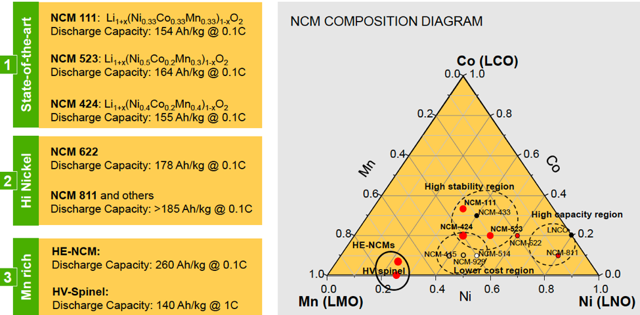

In general, increasing the nickel content in a cathode formulation will improve energy density but reduce stability, which means there’s a trade-off between cost and safety. This graph from a 2014 presentation by BASF and Argonne National Laboratory shows how the stability and cost of NCM batteries decline as nickel content and discharge capacity increase. It’s a trade-off. You get the best safety in the middle of the triangle with NCM-111. As you move toward NCM-811 in the bottom right hand corner, the discharge capacity increases but the cost and stability decline sharply.

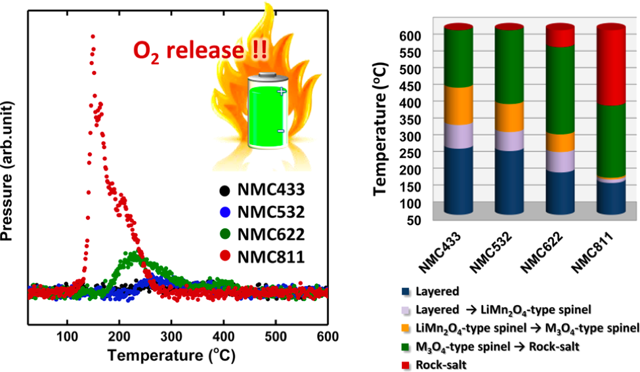

This next image from the ACS Journal of Applied Materials & Interfaces does a wonderful job of clarifying the stability risks of NCM-622 and NCM-811 cathode chemistries. As battery temperatures rise, free oxygen is released by the nickel oxides in the cathode powders. Since the electrolytes in most lithium-ion batteries are hydrocarbons, the addition of free oxygen and a spark in a sealed container is called a bomb. While the free oxygen release rates and pressures in NCM-622 cells may be within manageable safety margins, the free oxygen release rates and pressures in NCM-811 are far more problematic.

In an October 2017 Joule article, Professors Gerbrand Ceder of Berkeley and Elsa Olivetti of MIT summarized the critical investor takeaway as follows:

“While NMC-111 is already commercially well established and NMC-622 has seen recent market introduction, NMC-811 appears on the automotive roadmaps due to its superb energy content. It still suffers, however, from significant capacity fade and higher safety risks. We are skeptical that it will see widespread adoption in the EV industry within the time frame of our assessment (2025).”

I’ve dealt with hundreds of academics and researchers over the course of my career and this is the only time I can recall an academic expressing skepticism that a desirable objective can be achieved within an eight-year timeframe.

More recently, Marc Grynberg, the CEO of Umicore (OTCPK:UMICF), bluntly explained why battery manufacturers can’t design cobalt out of their products.

“If you increase the nickel proportion, you reduce the stability of the battery and so it has an impact on cycle life, the ability to charge it fast,” he said.

“Cobalt is the element that makes up for the lack of stability of nickel. There isn’t a better element than nickel to increase energy density, and there isn’t a better element than cobalt to make the stuff stable. So (while) you hear about designing out cobalt, this is not going to happen in the next three decades. It simply doesn’t work.”

Based on everything I’ve read, I believe NCM-622 is likely to become an important EV battery chemistry over the next few years. While I believe NCM-811 may become important if key technical hurdles can be overcome, I do not think that outcome is either imminent or assured. I also think additional cobalt reductions in future nickel-rich cathode formulations are unlikely.

He goes on to note that demand for cobalt from EV makers, under his NCM-622 scenario, will be 184 ktpa by 2025, and concludes:

Of the 104,600 tonnes of cobalt the world’s refiners produced last year, roughly 9,000 tonnes was used in EV batteries and the balance was used for high-value industrial applications and batteries for electronics and other portable devices. When the cobalt cliff arrives, the high-value industrial applications and batteries for electronics and other portable devices will be far less cost sensitive than the EV market. So from my perspective, the only supply EV manufacturers can count on is the surplus nobody else wants.

While two major projects in the DRC, Glencore’s Katanga mine and Eurasian Resources’ Roan Tailings Project, will ease the cobalt shortage over the next couple of years, their combined future production capacity of roughly 47,000 tpy represents about half of expected demand growth in the EV battery sector under the most optimistic chemistry scenario imaginable. In a more likely scenario where NMC-811 is not dominant, the combined capacity of the big projects will represent about a quarter of expected demand growth in the EV battery sector.

While an ever expanding variety of junior mining companies are emerging from the shadows and announcing new exploration projects, only three hobby scale projects are expected to produce cobalt before 2025 and their collective capacity of 6,700 tpy pales in comparison to the shortfall.

In its new "Cobalt Market Review 2017-18," Darton Commodities said:

“Do we think we are heading for the ‘cobalt cliff’ that some market commentators are predicting? The figures would suggest not quite just yet, as a 2017 demand increase to 103,900 MT was offset by a growth in supply of refined units of 104,600 MT. With Glencore’s Katanga asset coming on stream in 2018 and ERG’s RTR asset following on in 2019, the market could be in surplus until the exponential increase in predicted EV sales kicks in beyond 2020. However, with no new meaningful cobalt assets coming on stream at that time a heavy production/consumption deficit looks assured. On the basis of this longer-term outlook it is more likely that any near-term surplus supply will be pre-emptively purchased and stockpiled by larger consumers in anticipation of deeper, future supply deficits.”

Most of the world’s automakers will accept the cobalt cliff as an inconvenience that delays their announced plans to electrify portions of their new car fleets. They won’t be happy about the situation, but they’ll take the natural resource constraints in stride and continue making money by manufacturing and selling conventional automobiles.

Tesla and other pure play EV manufacturers will be pushed to the wall and most likely driven out of business because they have no capacity to weather sustained raw material shortages by manufacturing other products.

At this point, owning shares of Tesla is a sucker’s bet of the first order because the company cannot survive the cobalt cliff without a Deus ex Machina miracle that makes cobalt irrelevant to EV manufacturers. Cobalt may be a bridging material till something better comes along, but a bridge that isn’t long enough is called a pier.

I ought to point out that Petersen does not have a horse in this race. He is simply giving financial advice as he sees it.

John Petersen

Long-term horizon, nano-cap, micro-cap, alternative energy

Member Since 2008

Company: John l. Petersen, attorney at law

I’m a lawyer and accountant who’s devoted over three decades to advising clients on complex corporate finance, disclosure and reporting, and corporate governance issues. I’ve held board seats and executive suite positions in the mining, oil and gas and battery industries, and served as issuer’s counsel for several SEC registration statements. My decades of experience give me a unique insider’s view of the public and private equity markets and an encyclopedic knowledge of the business and technical issues I write about.

Over the last decade, I’ve earned a global following for my articles on the energy storage and alternative energy sectors. I’ve contributed to Seeking Alpha, The Street, NASDAQ.com, AltEnergyStocks, InvestorIntel and Batteries International Magazine.

I’m a 1979 graduate of the Notre Dame Law School and a 1976 graduate of the W.P. Carey School of Business at Arizona State University. I was admitted to the State Bar of Texas in 1980 and licensed to practice as a CPA in 1981.

My diverse experience in corporate finance, natural resource development and energy storage give me a unique and sometimes unsettling perspective on the technical, economic and supply chain challenges facing the battery industry.

Comments are closed.

The AA recently invited me to take part in their monthly online survey. A major part of this month’s survey was about EVs and from the wording of the questions, they obviously expect them to replace ICE vehicles in the not too distant future. Perhaps they should’ve read this article first. PS, for our non UK readers, AA in this case stands for Automobile Association. ;-

Very informative report so thank you Paul, it reflects very badly on our idiot government ministers.

Tesla have some big hurdles to clear to even survive into next year. Are there still enough ignorant virtue-signalling investors around to fund Muskrat’s next cash call to the market? Production targets are still some way from being met for the mass market Model S which is quite shoddy in its build quality.

I did read that the plan to halt sales of petrol and diesel fuelled cars by 2040 has now been down graded to a mere ambition. I guess someone has finally been doing some more serious reading around the subject.

https://www.express.co.uk/life-style/cars/974247/petrol-diesel-car-ban-2040-UK-Government

Mind you, I still think the penny hasn’t really dropped.

I’m still reading, but wonder about the number along side the first chart:

Namely, 532.

Text above has 523.

Both exist, and this is a minor point to what looks interesting.

Back to reading.

Ground breaking batteries and super capacitors are the new cold fusion. Everyone wants them and would like to believe they’re just around the corner. The difference is we can inch up on battery improvements but the holy grail of electricity storage will be sought for a long time to come.

Fascinating post, informative and enlightening – or not as the case seems to be, there ain’t a soul in Parliament, even many government apparatchiks who could make head nor tail of it.

Doomed, we most certainly are (and blinded by science! Elon Musk carries on taking the piss).

Let’s say EVs with large batteries become a niche market, while hybrids with small batteries become popular. Meanwhile, ICE autos improve, and remain dominate. The cobalt cliff recedes into the far future.

Here is something to think about:

Peak Copper