Whither US Oil Production?

By Paul Homewood

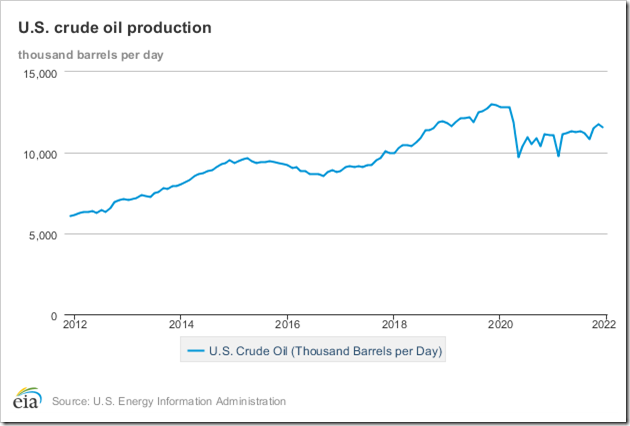

This single chart from the US EIA explains just why oil prices are shooting up there:

https://www.eia.gov/petroleum/production/

The oil boom initiated by Trump saw crude oil output increase by a half between 2016 and 2019.

Output naturally collapsed in early 2020 as a result of the pandemic, which affected both supply and demand. But since then output has only slowly recovered, and is still 9% below 2019 levels.

It is worth pointing out that demand in 2021 was still not back to 2019 levels. Assuming it recovers this year, it is likely to put further upward pressure on prices, unless production increases as well.

To put the numbers into perspective, the US produces a sixth of the world’s crude oil. The increase US output between 2016 and 2019 was 205 million tonnes, and represents 5% of global output.

Small changes in supply have a disproportionate effect on international oil prices, because demand is so inelastic. An extra 5% on world production would have a significant impact on prices.

Comments are closed.

This is hardly surprising. The Brandon administration has been openly hostile to oil & gas since the day it took office, blocking pipelines, rescinding leases, increasing the regulatory burden, etc.. In addition the shale companies have been pressured to show better fiscal discipline so are buying back shares and boosting shareholder returns as a priority over new drilling. The whole industry has been the target of disinvestment campaigns and efforts to limit access to capital.

In this climate why would a company commit resources to new projects when the rug could be pulled out from under their feet at any moment?

Well there you go. They should be happy with their work.

Instead of supporting the domestic industry to produce more at home (with all of the benefits in terms of jobs, tax revenue, etc) the administration is pushing for a soft nuclear deal with Iran and cosying up to Venezuela to try and get more foreign oil. They continue to badmouth their own players with patently false accusations about unused leases and the like.

You couldn’t make it up. Quite sickening.

Great analysis.

Fascinating that the green new deal proponents have said nothing about Biden releasing oil from strategic reserves to lower the price of gasoline, diesel and biofuels but increasing the amount of CO2 entering the atmosphere. Their protests and demands are coming home to haunt them. They can’t keep demanding we lower emissions without creating problems for world-wide transportation.

Covid related drops in demand led to lower production

The drop happens from March 2020 when Trump was President Biden wasnt in till 2021

I’ve seen people say that Big Oil was always in with Big Green

cos restricted supplies means bigger profits.

Whereas US shale was done by small operators .. and them increasing supply depressed prices.

And that Big Oil is against shale for this reason/

World oil prices have been a lot higher in the past .https://www.macrotrends.net/1369/crude-oil-price-history-chart

But the main reason that fuel prices have gone up to very high levels is that Green taxes have increased by a large amount .

From 2021 there was a large increase in ETS costs , which means that fuel refiners are paying more , and therefore the cost to the public has gone up by large amounts .

I don’t think we should do naive analysis like Green activists do

The factors than influence fuel prices are many, not just “green taxes”

And green taxes are complicated.

eg costs since 2008

– VAT was 15% now it’s 20%.. that is the ultimate tax on everything so is influential

– Minimum wage was about £5 now it’s £10

– Business Rates raised about £20bn now £30bn

– The govt has borrowed lots, so the £ is worth less than it used to be

– The govt has sent signals to fossil fuel biz , that it intend to close them down

Thus they invest less and run more expensively than they would do if they invested.

Petrol/Diesel

– Fuel duty was 50p and has been 58p/litre since 2010

– Fuel was pure, now it must have 10% bio and that is more expensive than base fuel

– Special wage rises were implemented to retain lorry drivers

– Price gouging with uncertainty in the market, petrol stations charge what they can get away with irrespective of true cost to them

Leccy

Grid costs are influenced by at least 3 effective Green subsidies to wind/solar

So a 2022 grid is way more expensive than a 2008 grid

– Priority Market access : Power stations used to be able to run flat out often

but now since wind/solar have priority they have to keep switching on/off, so their costs are more

– Green Infrastructure ..cabling to far off wind farms imposes costs

– High FIT payments for non-fossil fuels

Talk about naive , then come out with cost rises for 2008.

This is about the huge rises that have happened in the last year .

Wholesale grid prices have been steady at about £30 to £40 per MWh for many years . Then with the large increase in ETS in 2021 , the price has more than doubled .

Fuel prices have always varied , but with the huge rise in ETS for refineries last year , road fuel cost has increased by something like 60 to 80 %.

So , most of this is not about world events , or various other things that happened a long time ago , but about Green stealth taxes that have come in over the last year .

@InTheRealWorl As I said Green Taxes are complicated ..I didn’t include ETS costs for refineries

I’m guessing if they were that high the UK would start importing in refined petrol/diesel from abroad

Perhaps you’d like to quantify .. in £1.60 worth of petrol, how much of that is ETS ?

This article is about world oil prices, but

I find it hard to believe that UK power stations like Keadby which used to generate at around £40/MWh are generating at £80/MWh

Charging what people will pay is not price gouging. What’s the correct margin for retailers and how did you work it out?

I never said there is a “correct” price. Retailers are free to charge whatever they want, that’s business.

Definition “Price gouging occurs when a seller increases the prices of goods, services, or commodities to a level much higher than is considered reasonable or fair.”

Stewgreen , yes , green taxes are complicated . Perhaps deliberately so because if people knew that the increases were partly due to this scam they would have the Yellow Jackets out on the streets .

Paul did an article about it ,showing that the ETS increases the price for CCGT gas generation , [ which is very energy efficient ] , by about £32 per MWh, which is about double .

I do not know how efficient refineries are , but they all use oil or gas for their furnaces , which are their main energy use .

But even a small cost increase will then have fuel duty & VAT added on to it

which will overall add quite a bit onto the cost at the pumps .

An extra 5% on world production would have a significant impact on prices.

Government tax takes go up as pump prices soar. Scaling back the ‘excess’ tax take would be one way to cut the cost of everyday travelling life, as France is doing.

https://uk.news.yahoo.com/france-plans-2-2-billion-191649825.html

How does that happen ? US federal Fuel tax is a fixed amount per gall 18.4c and last raised in 1994

The French “solution” is classic French idiocy. The French (people and politicians) are the world’s worst economists.

You can’t lower general prices via general taxes.

Also government doesn’t get more VAT as prices on one good or service rise. Spending more on fuel means spending less on something else. Unless the shift is from non-VAT goods there’s no significant extra VAT paid.

I watched a youtube clip yesterday, one bottleneck to new oil wells in the US is the regulatory burden for federal land, apparently it takes over a year to get approval, compared with just a few weeks for private land.

Now look at global production.

https://www.eia.gov/outlooks/steo/report/global_oil.php

The small reduction in US output, is virtually a drop in the ocean.

Of more concern, is the a 18% of the UK’s diesel that comes from Russia.

.

Prices are set at the margin.

Meanwhile, China responds to high priced oil and natural gas.

https://oilprice.com/Latest-Energy-News/World-News/China-To-Expand-Coal-Use-As-It-Prioritizes-Energy-Security.html