BBC Brags About Hornsea Wind Farm–But Forgets To Mention The Cost

By Paul Homewood

Hornsea Wind Farm

In his puff piece for renewable energy today, the BBC’s Justin Rowlatt noted that:

Now the UK has the biggest offshore wind industry in the world, as well as the largest single wind farm, completed off the coast of Yorkshire last year.

Nothing could sum up the moronic obsession with renewable energy better than this statement. There is in fact a good reason why we have the biggest offshore wind industry – we are the only country daft enough to pay the exorbitant bill for it.

The largest wind farm, of course, is Hornsea, a 1200MW project. It may be the biggest, but it also happens to be one of the most expensive sources of electricity in the world.

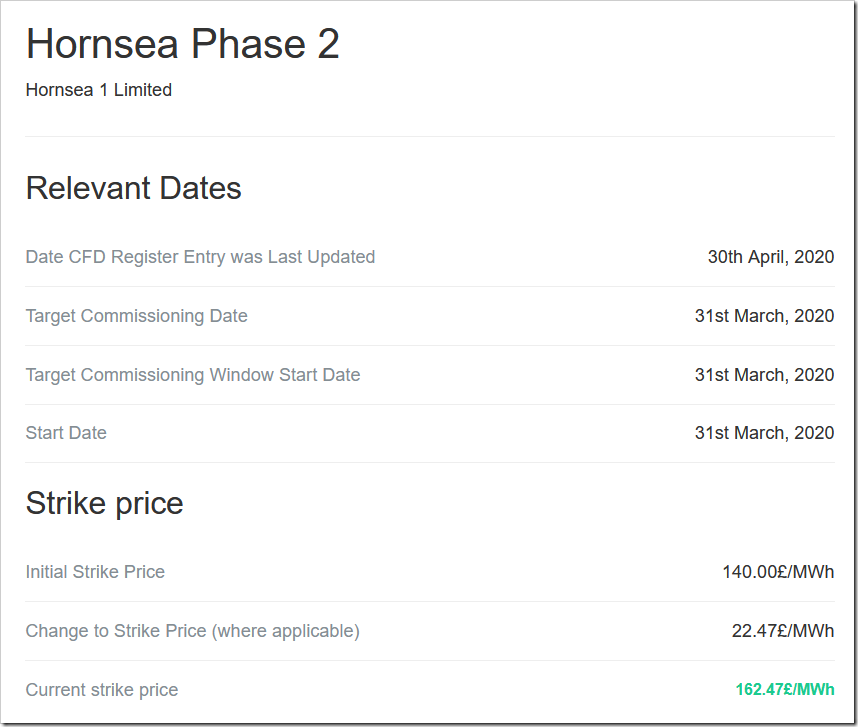

The contract price for Hornsea is £162.47/MWh, which under CfD is a guaranteed price, which will be index linked for 15 years. In short, a licence to print money.

https://www.lowcarboncontracts.uk/cfds/hornsea-phase-2

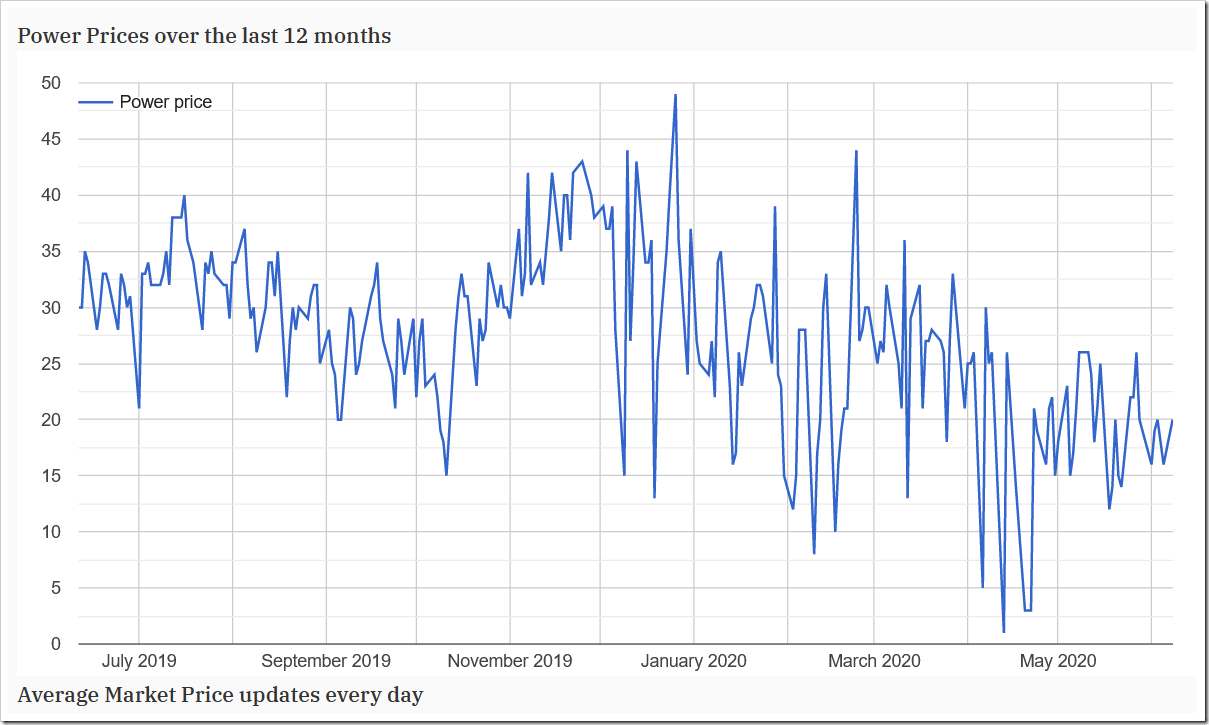

The current market price for electricity is below £20/MWh, so Hornsea is getting eight times what it would get if it had to trade in the market.

https://www.energybrokers.co.uk/electricity/historic-price-data-graph

At current prices, Hornsea will receive an annual subsidy of about £600 million. OK, if prices recover to more normal levels of around £40/MWh, once economic activity recovers, the subsidy will be slightly less.

But here’s the rub. Whether prices are high or low, Hornsea’s owners will receive their guaranteed price anyway. The system even allows them to sell every single unit of electricity they generate, and if there is a surplus of power in the market, they will get paid NOT to produce.

In other words, there is no commercial risk for Hornsea at all. A licence to print money, all at the expense of bill payers.

Hornsea, by the way, is joint owned by Oersted (formerly DONG) and Global Infrastructure Partners LLP, a global wealth fund. I find it hard to understand how sending hundreds of millions of pounds every year to either of those companies can possibly benefit the UK economy.

Maybe Justin Rowlatt might be able to explain?

Comments are closed.

And at the moment wind is producing a grand total of 0.63 GW.

VERY expensive electricity!

StephenP, surely the less electricity they produce the better? We can then get it, as Paul says, from sources which are one eighth the cost.

Why are we compelled to buy their electricity at such a high price?

Also why do we pay them that price when they have to shut down owing to oversupply?

I didn’t see the oil companies getting paid full price for fuel when it went into oversupply due to lockdown, the price at the garages fell. Basic economic theory!

Except we pay them when not producing.

Indeed…

The cost of balancing the grid over the Bank Holiday weekend amounted to £50m, and National Grid has predicted additional costs of £700m from May to August alone.

https://climatechangedispatch.com/uk-consumers-2-3b-annual-bill-prevent-green-energy-blackouts/

This folly is a guaranteed road to bankruptcy except they are stealing from the public to finance that idiocy. It is so frustrating to be a victim of what is really a criminal enterprise and be unable to oppose it. What makes it worse is that there are so many who have given themselves lucrative jobs, incredibly well paid with expenses and pensions and reward themselves with Knighthoods and such. Inevitably the country will be poorer and as usual the ordinary householder will suffer most.

There may be a (very risky) way to oppose it. Write to your electricity supplier and ask them to supply you with electricity from the cheapest source. You should also be able to get a breakdown of your bill, this will tell you how many units you used and the wholesale price your supplier paid per unit. If you assume £30/MWH as an average over 3 months this is 3p per unit. Therefore the wholesale price your supplier paid per unit minus 3p then multiplied by the number of units you used is the extra amount you have to pay for renewable energy. Refuse to pay this additional amount and tell the company why you’re not paying it, i.e. they supplied you with a product (renewable energy) that you asked them not to. I’ve no idea what will happen next (sadly I’m on a pay as you go tariff so can’t try this myself). If you run up large arrears and they take legal action I’ve no idea if the defence that they supplied you with a product you asked them not to would stand up in law.

Anyone brave enough to try this?

Hornsea also contributed to the 9th August power cut last year…

Justin Rowlatt oouldn’t explain anything to do with science, engineering or technology.

Meanwhile over on the Grauniad I quote their “wealth correspondent” and resident biologist

Rupert Neate………”Use of renewable power, such as wind and solar, has soared during the lockdown as it often has lower running costs than gas and coal plants and there have been favourable weather conditions.”

Even more bullshit than Jillian Ambrose could have dreamt up.

https://www.theguardian.com/business/2020/jun/09/great-britain-coal-free-industrial-revolution-electricity

One minor bit of cheer. A Thanet extension has been knocked back for now.

As I write U.K. Wind is producing two per cent of a very low demand. And I’m writing under the lamp in the kitchen waiting for the quiche Lorraine to hot up in the electric oven. Thanks to gas and nuclear.

Why do I get the feeling that our old fiend, Deben, has a finger in the Hornsea pie?

I just wish there was someone we could vote for to put an end to this renewables racket.

People ask and then don’t do anything about it, but here goes…

https://www.forbritain.uk/manifesto/

End pollution and protect our green spaces and wildlife/sealife

Prohibit universities or media from barring full discussion on climate change

Invest in small farms

End all green taxes and subsidies

Open new energy supply markets and invest in Britain’s petroleum industry

“Now the UK has the biggest offshore wind industry in the world, as well as the largest single wind farm, completed off the coast of Yorkshire last year.’

You are not the intended audience. BBC readers will love the story. Your ministers will brag about it at Davos and COP26.

Perhaps the next Labour govt. will nationalise it at a discount, and then scrap it ? One of the few things Labour is “good ” at ?

Listening to Radio 2 at lunchtime heard Harrabin claim that new offshore wind was able to compete without subsidy. That doesn’t sound correct at current prices but haven’t got that information to hand, if any one has grateful for an answer. He also claimed that once the wind farms were up and running anything they produced was free electricity ( let’s ignore the cost of capital then) so no maintenance or breakdown repair costs.

Have a look at the Contracts for Difference Register that Paul references above. You will be scandalised at the subsidy troughing on show from our favourite unreliables with strike prices way, way over the going market rate for electricity generation. Or non generation, as the case may be. Legalised theft I’m afraid.

Harrabin is utterly mendacious on this topic. I was motivated enough to take him on and complain to the BBC when he made a similar assertion a few months back. He was quoting 2012 unindexed base CFD prices for windfarms yet to be built or even financed without explaining that they were not the current, indexed prices, and comparing them to future projections of the cost of gas fired generation that assumed sharply rising gas prices – when instead gas prices have fallen. Here’s what I wrote for someone else who had encountered this fallacy:

There is no installed capacity that beats the very low costs of CCGT. The most recently completed windfarm is Hornsea, which caused the blackout last year. It is paid £162.47/MWh, which is above what some people pay as a retail price including all the other costs of the transmission and distribution network. Their phase 2 project has a CFD that is currently valued at £66.98/MWh, far above the costs of CCGT generation – even including all the green taxes that are levied on them – which are in the range of £30-40/MWh (partly depending on whether they are being used more expensively in wind balancing mode). That project may eventually come on stream in 2023. But we will still be paying for all the other capacity. As wind capacity is increased, we will be paying more and more for it NOT to produce, but be curtailed instead. When we add in the cost of curtailment, the cost of supplied power increases quite sharply (curtailment rises roughly quadratically). What we are seeing at present is just the beginning of the need to pay for curtailment. Double our capacity of wind, and the marginal wind farm will be more than 50% curtailed, doubling its effective cost.

It’s the wilful lying all renewables proponents engage in that enraged me Your link is a fine example of it.

The government is weak, intellectually bankrupt and frightened of the BLM and ER cults.

To which you can add stupid and incompetent.

True. Weak leadership is our greatest problem.

Golly, UK wind has gone up to four per cent of demand overnight!!!!

As the latest fashion seems to be to tear down icons that offend, can we suggest wind turbies be added to the list?

The BBC will never report the true cost of wind farms. It’s an ideology with them. I also see yesterday BBC weather on twitter were claiming 30° in the Arctic is astonishing. Has this happened before?

“The largest wind farm, of course, is Hornsea, a 1200MW project. It may be the biggest, but it also happens to be one of the most expensive sources of electricity in the world”

All that to reduce fossil fuel emissions without knowing the why of it.

https://tambonthongchai.com/2020/06/10/a-monte-carlo-simulation-of-the-carbon-cycle/

Wind electricity generation yesterday: Plus actual wind speeds for 29 locations in and around the UK for yesterday: https://www.weather-research.com/articles/uk-electricity-generation-09jun2020

I took a look at Hornsea’s output over the month of May via B1610 generating reports for HOWAO (the code for the Hornsea complex) from BMreports. The data may be affected by the cyber attack that hit Elexon, who run the BMreports site from which the data are (painfully, a day at a time!) downloaded:

https://www.elexon.co.uk/article/update-on-14-may-cyber-attack/

With the caveat that there appears to be some missing data ( though how much is uncertain, and also for prices, see later), I found that output was extremely spiky, largely split between periods of low or zero output, and periods of almost full (available) capacity, with little at intermediate levels. Average output was just 320.6MW over the month – just 26.7% capacity factor, which is poor for an offshore wind farm. Missing data points (or implied zero) out of 1488 (31 days of 48 settlement periods) for the 3 banks were 246, 261 and 230, with 180 periods of zero/missing across all three banks. It appears that production was lost for some hours from bank 1 on the 22nd, with the other two banks continuing flat out, which suggests a fault rather than an economic response.

I also looked at the APX day ahead settlement prices that are used for setting CFD payments (21 points missing, but output was low from the wind farm). A straight arithmetic average produced £21.63/MWh. Weighting by the actual output of the wind farm as recorded gives £16.84/MWh, which is in some sense the market value of the output (although perhaps looking at the System Sell/Buy price might be a better reflection of what a pool price might have been – but prices are in any case distorted by curtailment negotiations). However, that includes two periods when prices were negative. CFD payments are capped so that there is no payment beyond the value of the CFD if the price is negative, so a maximum of the CFD price is paid out and no more. Adjusting for this gives an average CFD payout of £143.50/MWh.

A further complication is that if these prices are negative for six contiguous hours or more, the payout is zero for the whole period of negative prices. Normally, market participants manage to avoid being caught by this by trading one period to a just above zero price, but market conditions and positions meant they were unable to even attempt this defence. On both the 22nd and 24th there were extended periods of negative settlement prices that gave rise to zero payment for any production. These reduced the overall average payout to £134.37/MWh produced – a subsidy of some £64.1 million for just one month. It is interesting to note than Hornsea actually appears to have curtailed its output almost completely for 9 out of the 15 contiguous hours of negative prices on the 24th – but ran flat out for the remaining 6 hours. It also did not curtail during the 6.5 contiguous hours of negative prices on the 20th.

I have no access to any detail on payments for curtailment, which would of course add to the subsidies consumers have to fund.

In the Orsted annual report they show how they get a $1.2bn grant (annual) from the Danish Gvt (who happen to be their largest shareholder) which is sized on plugging the gap between market price and guaranteed price… but what I read above (and what I thought) was that the British tax payer pays the CFD shortfall (and the bonuses for not producing)…. is the Danish Gvt grant related to only the wind energy produced in Danish waters? if so the subsidy that Orsted receives in even bigger than the $1.2bn in the AR… This is not a rant – but a genuine question – as I am curious…

Yes, it would appear the 1.2bn is only the Danish element

It’s not the British taxpayer who pays. It’s the British electricity consumer. Retailers (“suppliers”) get billed by the Low Carbon Contracts Company, and they pass the cost on in your bill:

https://www.gov.uk/government/collections/electricity-market-reform-cfd-supplier-obligation

Some supply to large energy intensive customers gets a partial exemption which has to be allocated among the rest of us.